Are you struggling to save money? or willing to have a streamlined banking experience? Well, let me introduce you to chime, an online-only bank that not only helps you to save automatically but also might meet all your financial needs in one place.

Chime is an advance digital bank that offers you great features which make it super easy to save your money, and with current Chime Promotions, you can get a $100 Chime Sign up bonus along with a $100 referral bonus.

Let’s see some of the best features offer by chime Promotions and How you can claim chime benefits.

What is Chime?

Chime is one of the most popular mobile banking platforms that are currently available. Which at the time was pretty revolutionary Chime is part of a wave of so-called Neobanks.

Unlike other banks, the Chime isn’t really a bank in and of itself, so it partners with both the bancor bank and stride bank, who will actually be handling your money.

This is a good thing because these banking giants offer up to 250 000 FDIC insurance for all your hard-earned cash; even if you haven’t heard of Chime, they have become one of the top Neo banks on the market with over 8 million account holders as of 2021.

Chime Promotions: $100 Sign up Bonus

Chime Promotions offer a $100 Sign up bonus when you join through our referral link and receive a direct payroll deposit of $200 or more within 45 days of opening your Chime Spending Account.

How to Claim Chime Sign up Bonus?

- Click on the above link to sign up on Chime.

- Now sign up using your email and password.

- Now verify your Identity using personal details.

- Once you set up a direct deposit and deposit $200 into your chime account, you will get your bonus.

- Your $100 Bonus will be sent to your account within 45 Days.

Want to gain interest on crypto holding? try our BlockFi Promotions.

Chime Referral Promotions: $100 referral bonus

If you have a verified chime spending and saving account, you can get an additional $100 Chime referral bonus when you invite new users through your unique referral link.

How to Claim a $100 chime referral bonus?

- Login to your chime account.

- Go to the referral section and copy your unique referral link.

- Once someone signs up using your referral link and creates a verified Chime account, then both of you will get a $100 Bonus.

Chime Features:

Chime offers a lot of features that can help you to save more money:

Chime Spending Account:

Fees Free: No overdraft. No minimum balance. No monthly fees. No foreign transaction fees. 60,000+ fee-free ATMs3 at stores you love.

Smart visa cash Back: with your chime spending account, you’re also going to get access to the chime visa debit card that you can use to make purchases anywhere that Visa is accepted.

But you’re also going to have smart savings tools like roundup savings that will round up your purchases to the nearest whole dollar and automatically move that money into your chime savings accounts.

Plus, you get access to their network of over 60 000 free use ATMs that have definitely been growing recently, and this can be located really easily from the app.

Chime Savings Accounts:

With your chime savings account, you’re currently going to earn a pretty decent 0.5 interest rate with no maximums.

Fees Free: With the chime platform across the board, your savings account again has no fees, is fully FDIC insured, and works with those roundup tools.

Paycheck Savings: You can also have Chime automatically save a percentage of your direct deposited paycheck, which we’ll talk more about in a second and clarify how you can actually get paid up to two days early now.

No Overdraft Fees: One of the newer features that Chime has actually added in the past few months is a fee-free overdraft that will actually cover all of your overdrafts on your chime debit card up to 200, and that even includes cash withdrawals.

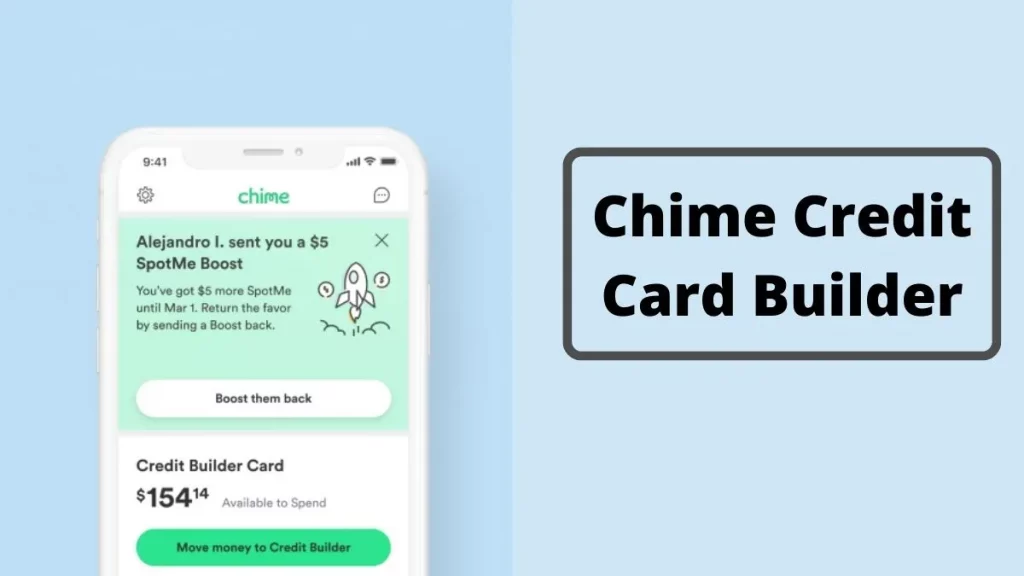

Chime Credit Card Builder:

The chime app is now the last big feature that I have not talked about yet is actually the new chime credit builder card which is a really unique product that allows you to build your credit.

Score without any annual fees ever, paying any interest at all, and even without ever going into any kind of debt like literally with this product, it is impossible to go into debt yet still allows you to build your credit score pretty quickly, which I think is really awesome.

Chime boost:

SpotMe Boosts can be given by Chime members to others to temporarily increase their limits. You can temporarily increase a friend’s SpotMe limit by $5 by sending them a Boost.

Chime Member Service agents cannot manually increase your credit limit for you. SpotMe is Chime’s optional, no-fee service that requires a single deposit of $200 or more in qualifying direct deposits each month to your Chime Checking Account.

Conclusion:

Overall, Chime banking is might profitable for you as you can get lots of benefits from Chime Promotions, such as a $100 Sign up bonus and a $100 referral bonus along with an advance credit builder.

FAQs

Does chime work with Zelle?

Yes, Zelle works with a chime. This means there is an established ground for users to undertake financial transactions between Zelle and Chime. Anyone who uses Zelle can use Chime.

Does chime show pending deposits?

Yes, You can see if you’ve received a pending deposit by going to the main screen. The status will be gray, so you can easily spot it. If you’ve received a deposit from a third party, you can cancel the transaction by going to the payments tab and canceling the transaction.

How to activate the chime card?

After you log in, you should see a card widget at the top of the app that says “Card Status.”

In the widget, you should see a big green button that says “Activate Card.”

If you do not see this button, ask the Chatbot, “Activate my card.”